International Taxation

We help enterprises formulate effective strategies to optimize their taxes, implement innovative tax planning strategies and effectively manage compliance-related requirements

Litigations

& Compliances

Regulatory Approvals

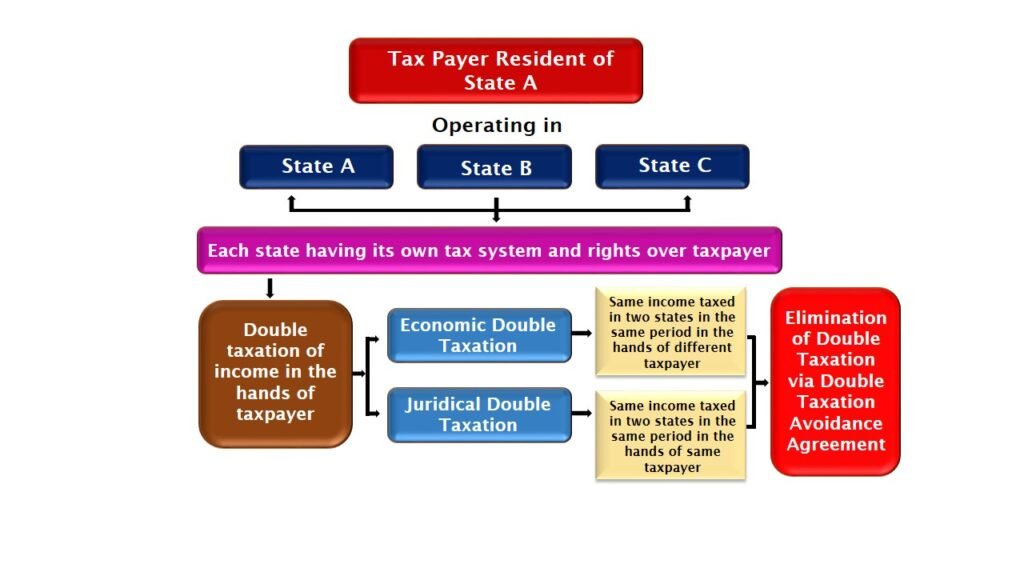

International Tax Services (ITS) provides corporate income tax advice on all aspects of cross-border transactions, including financing and structuring, transfer pricing, and operating model effectiveness. A global network of international tax professionals helps clients manage their business tax responsibilities, including managing global tax risks and meeting cross-border reporting obligations.

In a globalized world, there are changes coming from many directions and at a high speed. Therefore, it is important for a multinational corporations (MNCs) to be able to identify trends and their impacts as early as possible.

The Lex Koterie LLP is leading professional firm consisting team of dedicated and experienced international tax practitioners & professionals with technical & practical knowledge in practical fields. We provide worldwide up-to-date, country specific knowledge and information & manages the risk of multiple tax processes & regulations across the globe. Notably, our services include:

BEPS-PROOF TRANSFER PRICING HEALTH CHECK

A diagnostic health check will identify inappropriate BEPS transfer pricing policies and inadequate documentation from a BEPS and local standpoint. This will provide a clear summary of potential issues.

DEVELOPMENT OF TRANSFER PRICING MECHANISMS AND POLICIES

We will develop your transfer pricing policies and ensure they conform to OECD and local

country principles and regulations.

Preparation of transfer pricing documentation based on a functional analysis

We can help you prepare robust documentation to support the arms-length pricing nature of your related party transactions, including supportive transfer pricing studies and reports.

ADVANCE PRICING

AGREEMENTS

We assist throughout the negotiation process with a tax authority to agree a specified transfer pricing method which can be applied to certain transactions and remove uncertainty.

RESPONSES TO TRANSFER PRICING QUESTIONS FROM THE AUTHORITIES

We assist you in responding to tax authority queries, in any jurisdiction, where rational explanations of why your related party transactions comply with local regulations are required.

REPRESENTATION AND DISPUTE RESOLUTION

We will assist you to defend against additional tax assessments resulting from administrative or legal challenges to your transfer pricing policies.

Most Trivial Direct Taxes

Pricing

Expatriates

Years of Experience

We work with ambitious leaders who want their future to be successfull and help them achieve extraordinary outcomes.

Outstanding Service

Through our service lines, we help our clients capitalize on transformative opportunities - now, next & beyond.

Dedication to Clients

Together, we help you create lasting value & responsible growth to make your business fit for tomorrow.

Legal Consultant

You face steep compliance demands & complex changes; we help you transform your function to make a greater impact.

Professional Liability

Our professionals draw on our shared creativity, experience, judgement & diverse perspectives to reframe the future of our clients.