PAYROLL EXPERTIZE – empowers your business

“Our most valuable asset is its EMPLOYEES”

Compliance

Communications

Changing laws, working and compensation models increase the complexity of your payroll. These challenges lead to questions in the daily business even when you already have a well-functioning payroll process in place.

Lex Koterie’s payroll experts work with you to unravel the complexities, implement practical and proven solutions to overcome your challenges and help you manage your payroll more effectively. As one of your most critical processes, it’s essential that your payroll system always runs smoothly.

With our managed payroll solution, we manage everything from the data validation, calculation, payroll processing and reporting of your payroll, plus:

- Provide an experience employee payroll management platform.

- Ensure greater accuracy with up-to-date tax rates & regulatory information.

- Dedicated payroll specialist will be on hand to help with any queries.

Our payroll services eliminate the need for employing a payroll professional within your organization. Our dedicated and qualified, payroll professionals will support you with help and advice every step of the way in order to simplify payroll with dynamic customer service for quick & easy pay day.

What is Payroll?

Payroll is a list of employees who get paid by the company. Payroll also refers to the total amount of

money employer pays to the employees. As a business function, it involves:

- Developing organization pay policy including flexible benefits, leave encashment policy, etc.

- Defining payslip components like basic, variable pay, HRA, and LTA.

- Gathering other payroll inputs (e.g., organization’s food vendor may supply information about the amount to be recovered from the employees for meals consumed).

- The actual calculation of gross salary, statutory as well as non-statutory deductions, and arriving at the net pay.

- Releasing employee salary.

- Depositing dues like TDS, PF, etc. with appropriate authorities and filing returns.

In short, we can say that payroll process involves arriving at what is due to the employees also

called as ‘net pay’ after adjusting necessary taxes and other deductions.

Stages of Payroll Processing

Statutory Compliances in Indian Payroll

Payroll processing is an essential business function that involves arriving at the ‘net pay’ of the employees after the adjustment of necessary taxes and deductions. For an efficient payroll management process, the payroll administrator needs to plan the payroll process step-by-step and need to monitor changes to with holdings, contribution to social security funds, etc. The entire process can be split into three stages, pre-payroll, actual payroll and post payroll activities.

Pre Payroll

Activities

Defining Payroll Policy

Gathering Inputs

Input Validation

Actual Payroll Process

Payroll Calculations

Post Payroll

Process

Statutory Compliances

Payroll Accounting

Payout & Reporting

Statutory Compliances in Indian Payroll

When you run payroll, being statutory compliant means that you are paying as per the applicable employment norms set by the central and state legislation. The common statutory requirements that apply to Indian businesses include the provision for minimum wages, payment of overtime wages to workers, TDS deduction, contribution to social security schemes such as PF, ESI, etc.

While computing salary you need to consider all these deductions and contributions. Income tax is one such deduction. At the beginning of the year, the employee is asked to make a declaration about his additional incomes, tax saving investments, etc. called as ‘income tax declaration.’ Accordingly, employee’s tax liability is calculated, and TDS is deducted.

Why Lex Koterie LLP payroll expert?

Simpler Payroll

Lex Koterie LLP helps to overcome the complexities & risk associated with sourcing, managing & delivering payroll services

Deep Expertise

Deep expertise in payroll services & access to different experts with expertise such as immigration, tax, social security.

Increased Accuracy

We unify & standardize your payroll processes and improve efficiency & payroll compliances.

Support

Support & implementation regarding insurance coverage/ contract related to social insurances.

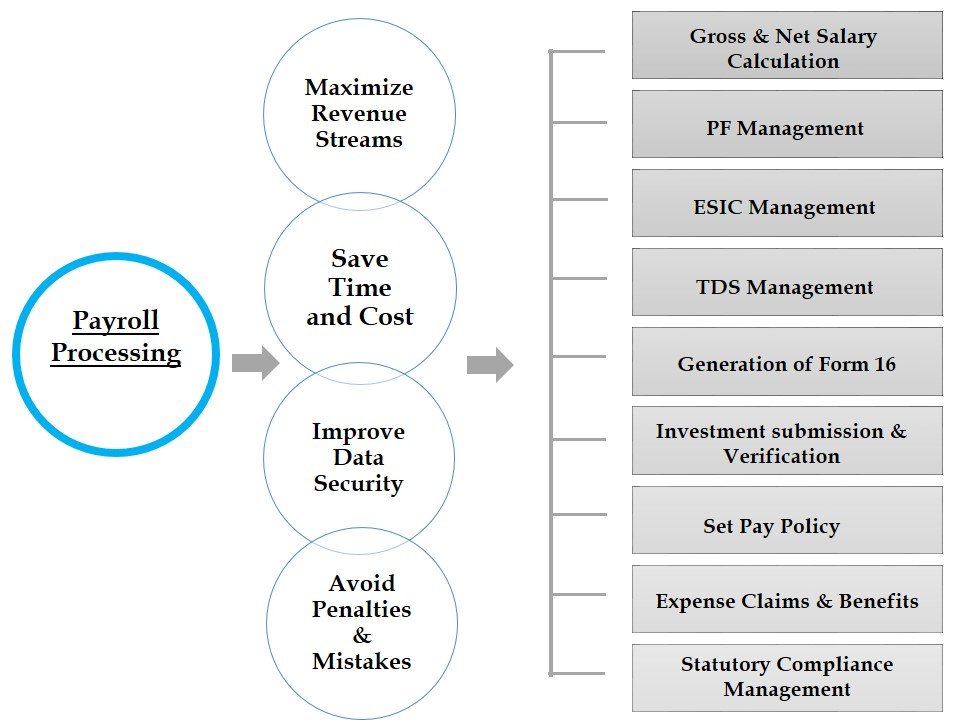

Payroll Processing Services

HR & Labour

Compliances

Customized Payroll

Services

Attendance & Leave Management System

Years of Experience

We work with ambitious leaders who want their future to be successfull and help them achieve extraordinary outcomes.

Outstanding Service

Through our service lines, we help our clients capitalize on transformative opportunities - now, next & beyond.

Dedication to Clients

Together, we help you create lasting value & responsible growth to make your business fit for tomorrow.

Legal Consultant

You face steep compliance demands & complex changes; we help you transform your function to make a greater impact.

Professional Liability

Our professionals draw on our shared creativity, experience, judgement & diverse perspectives to reframe the future of our clients.